Due to the current and foreseeable situation with the COVID-19 and social distancing rules, lenders are having to adopt a digital mortgage application process.

03 Jun 2020

Technology has simplified the application process by presenting an end-to-end experience, improving customer experience and speeding up the process.

What is a Digital Mortgage?

A digital mortgage uses technology to create a mortgage that is produced, allocated, and stored digitally. For the customer it is a quick and seamless process from the comfort of their homes. For banks, it reduces manual processes, human error, and costs.

Buying a house is the biggest investment that most people make. It seems obvious that the only differential value could be the conditions of the mortgage product. However, improving the customer´s experience significantly increases conversion rates. The challenge is to convert the mortgage process into a differential experience that facilitates and expedites all the external procedures that takes place, such as registration and ownership changes in utilities on the telephone and TV providers.

MARKET RESEARCH

The most important and least satisfying steps in the home- buying process, according to customers are:

- Mortgage application

- Research and plan the process

- Conveyance/ closure process

Preferred channel preferences:

- Discovery/ research stage: 38% website self-service

- During loan application: 22% phone, 22% in person

- After closing: 27% e-mail

The digital experience has changed for new generations (there are now many different communication channels that are not face-to-face), therefore digitising this process is particularly important:

- Millennials prefer to communicate less in person and more electronically- especially during the application phase, and regularly on the phone during application and after closing the deal.

- Generation X prefer slightly more e-mails and less phone calls throughout the process.

- Baby Boomers prefer less electronic communication and more communication in person.

What does it take to deliver an industry-leading, customer-centric, and integrated Digital Mortgage experience?

PROCESS: HOW DO WE AIM TO SIMPLIFY IT?

Technology has simplified the application process by presenting an end-to-end experience, improving customer experience and speeding up the process.

This journey aims to simplify the tedious process of mortgage applications. The paperless course will let people apply remotely; this is vital, especially now that in-person application poses a potential risk due to COVID-19.

Customer experience is crucial in this case as the process is emotional and intense from start to finish. It is not just about the cost involved, but the whole experience, therefore generating the most value and highest efficiency will improve conversion rates.

The digital journey becomes part of the mortgage USP, making the loan application pain-free, simplifying the process by incorporating external processes which are necessary for the approval of the loan. Each step of the mortgage application needs to be simple and self-explanatory, where navigating the app or website is as easy as logging onto Facebook.

Even though the customer is not working with a banker, broker or relationship manager, the expectation is still that they want an experience where they can trust the institution and feel comfortable throughout the online mortgage application. Today, the difference in what lenders can offer regarding cost and interest rates are generally minimal, and therefore the customer experience, the convenience of the entire process, becomes paramount in the acquisition of a new customer.

The benefits of a Digital Mortgage

Borrowers nowadays have grown up with technology; making it easier for them to understand how to apply for a mortgage and fill out the applications online. The digital process meets the borrowers’ expectations as banks can handle applications more efficiently – creating a smoother procedure.

Most conventional banks operate in a traditional way. All documents are delivered physically, leading to verification from the broker/lender. This makes the process time-consuming as verifying documents during an application can be tedious.

A digital mortgage will shorten lender review time, increase the quality and consistency of the reviews and allow employees to work on high-risk loans or other activities to speed up processing.

DIGITAL MORTGAGE SIMULATION

A combination of OCR, text analytics and machine learning can be used to collect, scan and ratify loan documentation to their appropriate departments to reduce processing timelines and FTE’s to manually review each document.

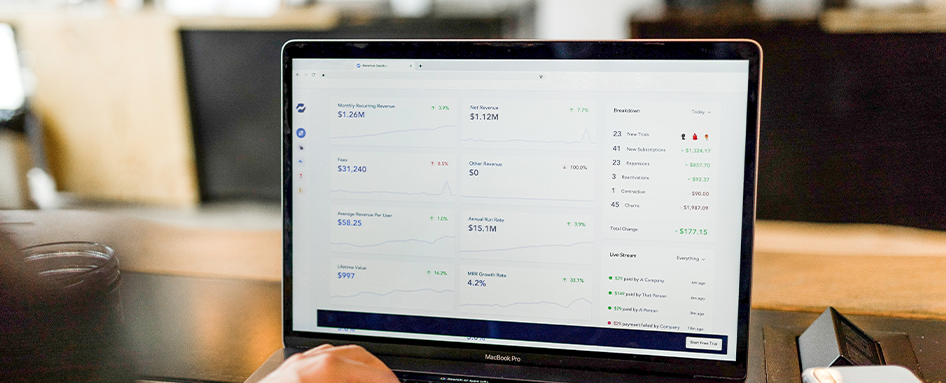

As home buyers enter their information and upload documentation, everything is instantly captured on the lender’s loan system. This enables them to start the loan disclosure process. This process automatically inputs the customer’s identity, assets, and property information to support a seamless mortgage application experience – anytime, anywhere, and on any device.

The Digital Opportunity

As technology continues to push the boundaries and heighten the expectations of customers in all walks of life, so must the lender’s digital strategic roadmap. By enabling customers to understand their borrowing capacity upfront through a digital process, customers are more likely to then fulfil their property purchase, improving the conversion rates for the bank. It is important to create a seamless digital journey for customers assuring them that the financial institution will give them an accurate picture of how much they can afford to borrow.

A digital mortgage is less hectic, it is processed more quickly, and identifies any potential difficulties to be corrected sooner. Tasks and procedures that previously needed time and paperwork are now done quicker, improving turnaround time and effectiveness. Most lenders are embracing a digital strategy, meaning that competitive differentiation will be measure in inches, not miles, with many new entrants to the market having an online-only strategy, which are gaining on the traditional lending institutions.

VASS is in the unique position of having the experience and understanding of the mortgage process and the in-depth technological expertise to help mortgage lenders rapidly deploy solutions by making the right changes across their operations. This will lead to increased customer acquisition and retention, while improving automation and the customer experience, while lowering costs.

The future of mortgages is digital. Is your company ready?

Facebook

Facebook

X

X

Linkedin

Linkedin