Banking Verticalization

11 Nov 2021

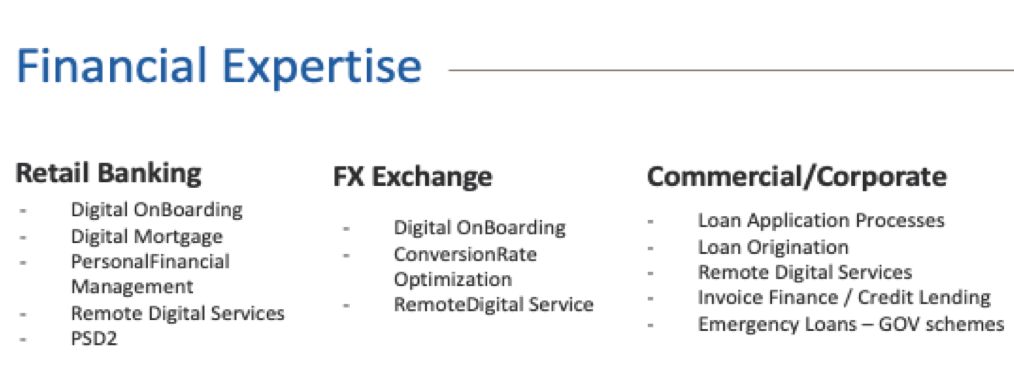

Financial Services is an industry with a wide-range of challenges and opportunities, covering end to end line of businesses: Retail, Insurance, Commercial Banking, Wealth Management, etc.

The complexity of a number of IT platforms at a company’s stack grows every day. According to an industry depth analysis, “81% of banking CEOs are concerned about the speed of technological change, more than any other industry sector”.

Therefore, Salesforce For Financial Services was born to create continued experiences with a single unified platform focus on the main industry goals:

- Customer omnichannel digital experiences for consumers and partners (Digital Onboarding)

- Operational Efficiencies to intake and process documents (Digital Mortgages, Underwriting processes)

- Compliant Collaboration (PSD2, MIFID II)

- Industry Data Model (B2B2C)

- Personalised Relationship Intelligence (Wealth Management or Private banking)

- Integrated Business Process (Loan application processes, Agribusiness, CBILs)

Financial Services is an industry with a wide-range of challenges and opportunities, covering end to end line of businesses: Retail, Insurance, Commercial Banking, Wealth Management, etc.

The story

Salesforce Financial Services Cloud (FSC) was created five years ago as a focused area on Wealth Management with the ambition to help advisors deliver personalised and proactive advice to their clients in real-time. Since then, Salesforce has invested a lot to deliver an integrated platform designed to drive outstanding customer engagements.

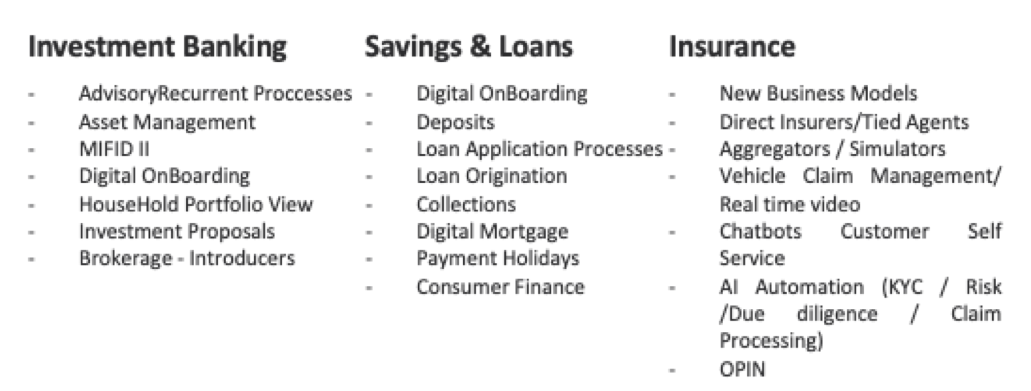

Today, FSC is a fact and have more than 500 customer success stories from wealth management to insurance companies and banks, solving the challenge to unify Customer’s 360º view and households through different touchpoints such as: branches, contact center, online, mobile or financial center.

The key to Salesforce Financial Services Cloud is its function as an accelerator where no process has to be implemented but instead serves in the process optimisation for such a niche industry.

Accelerating Time to Market

With the breadth and diverse nature of the financial services business across Salesforce expertise… learnings, innovative solutions and accelerators (pre-built solution frameworks) are achieving best possible Return-on-Investment in a record Time To Market.

As an example, VASS was the first Salesforce Partner to implement Financial Services Cloud in EMEA at our customer Credit Andorra, where we were able to achieve three main goals:

- Customer Portfolio 360º view to understand and generate insights and value.

- Investment Proposal Automation providing advisory real time capabilities to adapt portfolio and assets to their customers

- Complete MIFID II compliance solution based on change management and customer interactions.

More info can be found below during our presentation at Dreamforce:

Credit Andorra Reference Case Dreamforce 2017-2018: https://www.salesforce.com/video/1757595/

Pibank Reference Case Dreamforce 2018-2019:

https://www.salesforce.com/video/3621790

Stop reinventing the wheel and Accelerate with FSC

Salesforce for Financial Services provides Out of the Box accelerators which help on any banking process automation. We have just summarized the most relevant ones next:

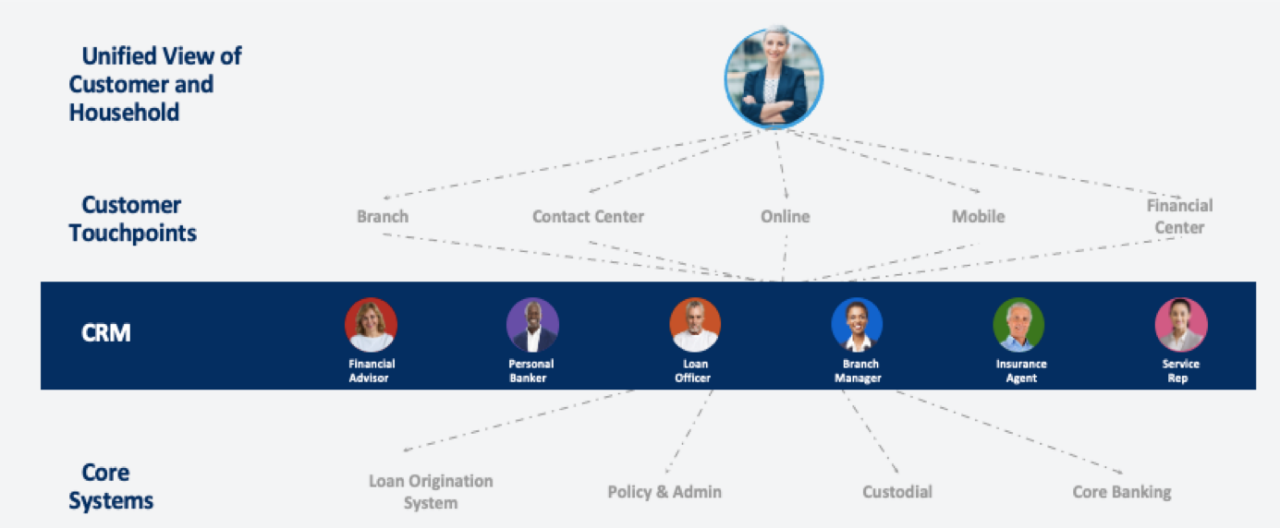

1. Relationship Groups/Households

Household represents a group of clients and businesses whose financials are summarized at the group level.

Group represents a collection of Individuals and/or Institutions that are related for specific purpose (Household, Professional, Trust, etc.)

FSC tracks each client or entity’s specific role(s) within that household.

The financials for each client or entity that is a member of the household can be rolled up to the group level for an aggregate view.

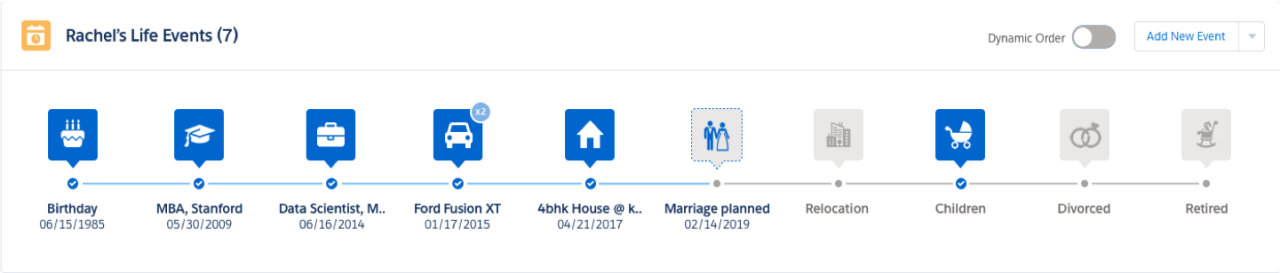

2. Person Life Events

Life Event is any event that results in an opportunity to understand the customer context. It needs better thus facilitating empathetic customer engagements and up/cross-sell of policies.

As a User (Insurance agent/CSRs) Life event component should be an interactive and visual storytelling element facilitating easy information capture mechanisms of his clients. It should also aid in spotting the right opportunity ahead of time to make the most of the Policyholder 360 info.

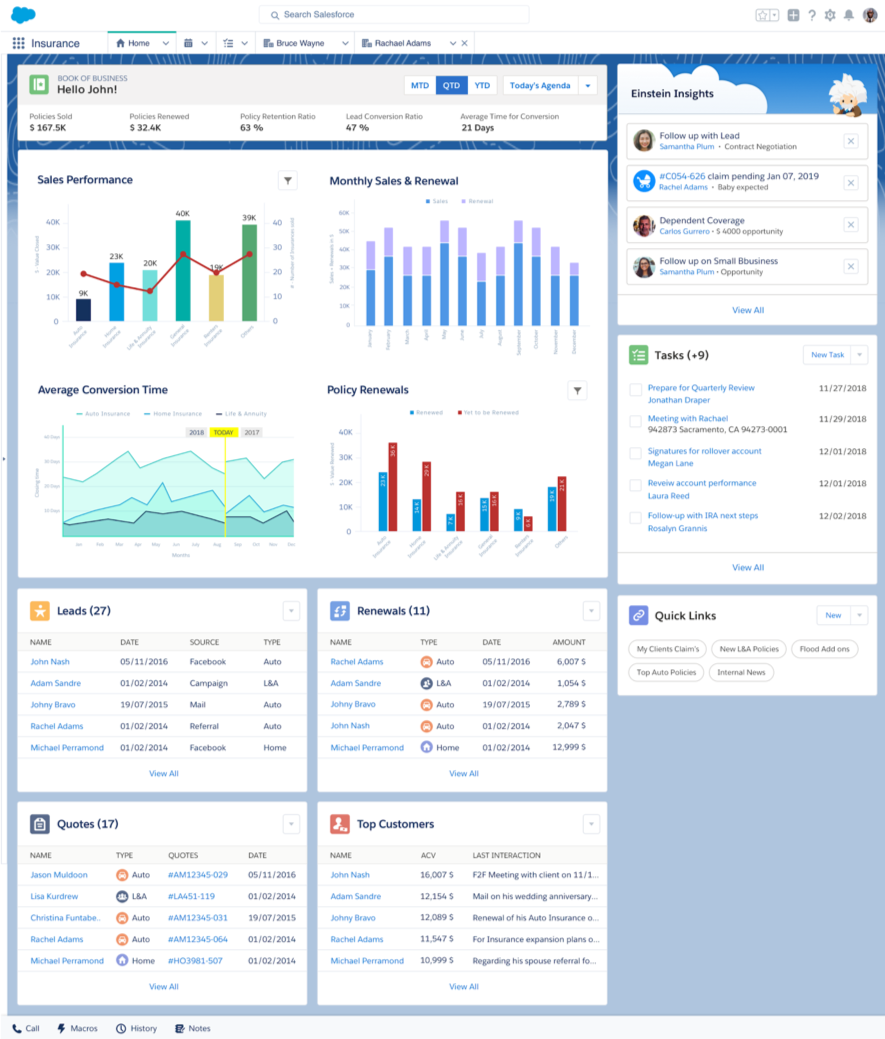

3. HomePage

There are different sections handling different kinds of information:

- Highlight Panel representing the progress on Key KPI’s

- Reports indicating the Agent’s performance

- Other Out-of-the-Box Components like Tasks, Recent Records, Assistant

- 360 view of the Agent / CSR’s Book of Business

- Helps prioritise his/her focus areas

- Helps become efficient and effective

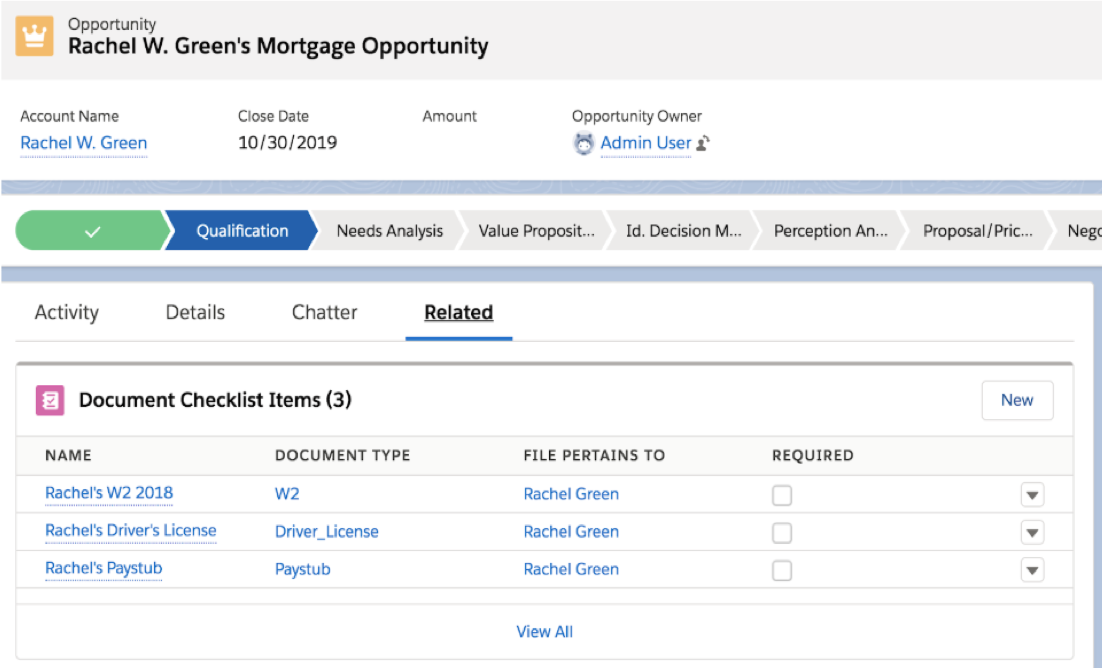

4. Underwriting process flow

Standardize document collection by defining templates of documents required for each type of opportunity. (W2, driving licence, pays tub)

Support compliance by tying each document to a customizable approval process.

Enhance convenience for borrowers by enabling them to upload documents and track approvals via Portals.

Our mission

VASS is a Global Salesforce Platinum Consulting Partner. We are a Salesforce multi-cloud expert with focusing on the Financial Services Industry. We were founded in 1999, with the mission to offer our clients cutting-edge specialised services.

VASS has successfully delivered 150+ Salesforce Projects, 50+ in Financial Services and 12 Salesforce Financial Services Cloud implementations over the last 10+ years as a Salesforce Partner. By using our accelerators (pre-built solution frameworks), we accelerate our customers’ time-to-value for Digital Onboarding, Wealth Management, MIFID II and Investment Banking, to name a few examples.

When analysing banking and insurance, it is vital to hold technical knowledge of the platform. Especially regarding integration with core banking systems like Avaloq, Mambu, etc., which is the usual and the main challenge these big companies have. It is, however, even more, essential to know how to extract the data and create processes in the front end that simplify the dynamic not just for the bankers but for the clients. They must speak the same language.

We created a series of accelerators and business-based solutions which hold technical knowledge, all aimed at the acceleration of needs in a specific market niche. Our modus operandi is like one of a start-up, making us extremely agile in our delivery.

We analyse the process and implement the accelerators in a brief period, study return on investment and adjust accordingly. It is an ongoing process of improvement, where we explore and improve our clients’ KPIs. This experience delivery exceeds geographical borders – through extensive thought leadership, we provide FSC experience in all the countries where we are present.

At VASS, we strive to become the number one FSC partner by providing leadership, growth, and excellent service for our clients. We plan to do so through three main pillars of action: creating the Financial Services Blueprint, harvesting account growth and achieving service excellence.

Facebook

Facebook

X

X

Linkedin

Linkedin